恐慌和混乱将会爆发

纸币的消亡是必然的

为什么黄金和货币一样有用

繁荣和萧条是如何产生的

驾驭正确资产类别的相反周期

Once in a lifetime opportunity

千载难逢的机会

More than any other time in history,people can exponentially increase their standard of living during this upcoming collapse,without being exposed to great risk.Normally the precious metal community's wisdom says that gold and silver are not investments,but rather they are wealth insurance.While this has always been true in history,there also were brief moments where gold and silver have been simultaneously the safe haven and the best performing investments,achieving truly massive gains in absolute purchasing power.

在即将到来的经济崩溃中,人们的生活水平比历史上任何时期都要高,而且不会面临巨大的风险。正常情况下,贵金属界的智慧告诉我们,黄金和白银不是投资,而是财富保险。虽然历史上一直如此,但也有短暂的时刻,黄金和白银同时成为避风港和表现最佳的投资,在绝对购买力方面实现了真正的巨大收益。

目前即将到来的财富转移是在全球失衡的背景下进行的,这种失衡使以往的任何一次都相形见绌。但是,这一点与这样一个事实相结合,即所有世界货币都是法定货币,表现出到期和死亡的迹象。这是历史上前所未见的令人难以置信的独特情况。这可能是人类一生中仅有的一次存在,一个可能永远不会再发生的机会。即将到来的财富转移将达到前所未有的规模。购买实物贵金属正迅速成为一种被广泛认可的投资,它将在未来造福你和你的子孙后代。

Whatever the price is for gold and silver,if the world's currencies were to collapse,the purchasing power of those who have not accumulated gold and silver or other precious metals would get transferred to those that did,and that will be a mind-boggling quantity of wealth.More than in any other time in human history,people that own precious metals will be able to increase their standard of living exponentially during the coming upheaval,without being exposed to great risks.

无论黄金和白银的价格如何,如果世界货币崩溃,那些没有积累黄金和白银或其他贵金属的人的购买力将转移到那些积累了黄金和白银或其他贵金属的人手中,这将是一笔令人难以置信的财富。与人类历史上任何其他时期相比,拥有贵金属的人们将能够在即将到来的动荡中成倍地提高他们的生活水平,而不会面临巨大的风险。

目前,全球正处于黄金和白银的下一轮大牛市的早期阶段,如果不尽快采取行动,你可能会错过快速、轻松、三位数增长的机会。在接下来的一个月里,金价将翻一番,银价将翻三番!因此,赶快买你能买的东西,以免价格太高而买不起,那就太晚了。金银将是真正的赢家,但这一次财富转移的绝对比例非常巨大。

Knowledge is power that can be worn as a suit of armour,and Truth is a weapon that can be wielded like a sword,slicing through the propaganda of misinformation and deceit,laying bare the lies for all of us that are AWAKE,so now there is no fear but just enthusiasm to defeat the Deep State cabal for once and forever.

知识是一种可以作为盔甲的力量,而真理是一种可以像剑一样挥舞的武器,它可以切开错误信息和欺骗的宣传,为我们所有清醒的人揭露谎言,所以现在没有恐惧,只有热情去打败深层国家阴谋集团,一劳永逸。

Panic and chaos will break out

恐慌和混乱将会爆发

The world's silver supply would be gone in a nanosecond once the people realise there isn't as much metal as is believed,because it's a very small quantity available for sale.At this moment,there's a shortfall in the world's gold supply.The message is clear:Buy gold and silver coins and bullion now,for as much as you have liquidity available,and keep doing so till the prices escalate.The world is running out of silver,which makes Silver the dark horse in the market.

一旦人们意识到世界上没有人们想象的那么多的金属,世界上的银供应将会在十亿分之一秒内消失,因为可供出售的金属数量非常少。此时此刻,世界黄金供应出现短缺。信息是明确的:现在就购买金币、银币和金条,只要你有足够的流动性,并保持这样做,直到价格上涨。世界上的白银快用完了,这使得白银成为市场上的黑马。

市场越来越短缺,央行也已经弹尽粮绝,所以最终会到达一个临界点,即投资公众对美元和其他所有纸币完全失去信心。总有一天,人们会意识到,持有一份根本不存在的黄金或白银的购买合同,不值得印在纸上,所有纸币也是如此。恐慌和混乱将会爆发。准备好迎接连锁反应的崩溃吧,把所有拥有纸张的人都赶尽杀绝吧!

Gold and silver have revalued themselves throughout the centuries and defeated all fiat currencies,bringing those fraudulent monies to justice.This is as certain as the sunrises in the morning.The honest physical precious metal investors will be rewarded with gains that will overshadow the stolen wealth by the Khazarian thieves.

几个世纪以来,黄金和白银对自己进行了重新估值,击败了所有的法定货币,将这些欺诈性的货币绳之以法。这就像早晨的日出一样确定无疑。诚实的有形贵金属投资者将获得回报,这些回报将掩盖凯萨人盗窃财富的事实。

Demise of paper currencies is a certainty

纸币的消亡是必然的

信贷的另一面是债务,这就是问题所在。创造多少货币是没有限制的。在一个有真正货币的世界里,每增加一个货币单位就意味着更多的财富。但法定信贷或债务货币就不同了。有了信贷,支出可以大幅增加。但可以借多少钱是有限度的。最终,现金流会到达一个临界点,由于偿还债务利息,现金流会枯竭。在这一点上,这个体系已经破产。

Fiat Currencies lead to corruption and a crushing debt burden,which are at the root of the world's troubles.Virtually everywhere,governments and their citizens are borrowing more than ever before,and in many cases,they are far beyond any chance of orderly repayment.The point of no return has been passed–where even at zero interest,payments drown the ability to generate free cash to cover those payments.Consequently,the debt burden is growing greater and greater.It must be clear by now;the banksters thrive spectacularly when fiat currencies are in place,at the people's expense.

法定货币导致腐败和沉重的债务负担,这是世界麻烦的根源。几乎在所有地方,政府及其公民的借贷都比以往任何时候都多,而且在许多情况下,他们远远没有任何有序偿还的机会。不归点已经过去——即使在零利息的情况下,还款也会淹没产生自由现金来支付这些还款的能力。因此,债务负担越来越重。这一点现在必须清楚:当法定货币到位,以人民为代价时,银行家们才能兴旺发达。

When interest rates are pushed down by central banks to artificially low levels and held there for an extremely long period of time,credit expands and the burden of debt grows.That has been happening for almost four decades.And now,the entire economy depends on something that cannot continue,as debt cannot grow forever.

当中央银行人为地将利率压低到很低的水平并在那里保持很长一段时间时,信贷就会扩张,债务负担就会增加。这种情况已经持续了近40年。而现在,整个经济依赖于某种无法持续的东西,因为债务不可能永远增长。

As long as rates stay low,the system is maintained and supported,but as the amount of debt increases,the quality decreases.Debtors'balance sheets become weaker and weaker.Eventually,the credit markets change direction.Interest rates start rising.Then the weight of all that debt comes crashing down like an avalanche.And once it gets started,there is no stopping it.

只要利率保持在低位,这个系统就能得到维持和支持,但是随着债务的增加,质量就会下降。债务人的资产负债表变得越来越弱。最终,信贷市场改变了方向。利率开始上升。然后,所有债务的重量像雪崩一样崩塌下来。一旦开始,就无法停止。

银行系统是一种荒谬的商业模式:他们借出他们没有的钱,然后向贷款人收取利息。此外,"部分准备金贷款"允许银行贷出比存款多十倍的款项。换句话说,他们借出他们没有的、甚至根本不存在的"钱",正确地称为"信用货币"——而他们在法律上被授权收取利息。

It does look increasingly certain that the end of the fiat money hegemony is in sight.The only questions at this point are:When does it end,and when does the real panic begin?Regardless of the timespan,the demise of paper currencies is a certainty.

看起来确实越来越确定的是,法定货币霸权的终结即将到来。现在唯一的问题是:什么时候结束,真正的恐慌什么时候开始?无论时间跨度如何,纸币的消亡是必然的。

The fiat economic system's counterfeit money makes counterfeit public policy,and ultimately destroys an economy,a society,and a political system.In short,when money can be created by just tapping a few keys of a computer,people are brainwashed to believe anything.

法定经济体系的假币制造假冒的公共政策,并最终摧毁一个经济体、一个社会和一个政治体系。简而言之,当金钱可以通过敲击电脑的几个键来创造时,人们会被洗脑去相信任何事情。

Why gold is so useful as money

为什么黄金和货币一样有用

这些人可能认为关闭整个经济是可以的,因为他们可以用"政府的钱"来弥补损失但是政府的"钱"是伪造的。真正的钱是真实世界的一部分。它是有限的,就像时间一样。不可能仅仅因为有了更多的资金就创造出多余的资金。如果政府想用真正的钱来资助一个项目,他们就必须从别的地方拿钱。这就是为什么黄金和货币一样有用。黄金是有限的,就像时间本身一样。每一盎司的石油都必须被发现,从地下挖出,加工和储存。

This is the way that gold connects"money"to the real world of time,sweat,toil,and risk.In that real world,any decision,any choice,must be considered in light of compromises.How much time will it take?How many resources will be required?What does it take away from the other things we want or need?

这就是黄金连接"金钱"与现实世界的时间、汗水、辛劳和风险的方式。在那个现实世界中,任何决定,任何选择,都必须在妥协的基础上加以考虑。需要多长时间?需要多少资源?它从我们想要或需要的其他东西中带走了什么?

Usually,these questions are reduced to a single one:How much does it cost?But did anyone bother to ask that critical question as the COVID programs were rolled out–the Lockdown,the Rescue,the Pay-check Protection Program(PPP),and unemployment compensation?The lunacy of the unemployment bonus is obvious.The average recipient actually earned more money from unemployment compensation than on the job,where wealth was created.The economic law of honest exchange demands only things of real value instead of currency that can be manipulated.As German-American economist and philosopher Hans-Hermann Hoppe once said:

通常,这些问题被简化为一个单一的问题:它的成本是多少?但是,当 ovid 项目开始实施的时候,是否有人费心去问这个关键的问题——封锁、救援、支付支票保护计划(PPP)和失业补偿?失业奖金的疯狂是显而易见的。事实上,平均每个领取失业救济金的人比在工作岗位上挣得更多,而工作岗位是创造财富的场所。诚实交换的经济法则只要求有实际价值的东西,而不要求可以操纵的货币。正如德裔美国经济学家和哲学家汉斯-赫尔曼·霍普·马丁曾经说过:

"By virtue of the saver's saving,even the most present-oriented person will be gradually transformed from a barbarian to a civilised man.His life ceases to be short,brutish,and nasty,and becomes longer,increasingly refined,and comfortable."

"由于储蓄者的储蓄,即使是最注重当下的人也会逐渐从野蛮人变成文明人。他的生命不再短暂、残忍、肮脏,而是变得更长久、更加优雅、更加舒适。"

Everyone by now should know that today's money is phony,all the compensation programs are fake,the economy is counterfeited,and the stock market is a scam.

现在每个人都应该知道,今天的钱是假的,所有的补偿计划都是假的,经济是假的,股票市场是骗局。

How Booms and Busts are created

繁荣和萧条是如何产生的

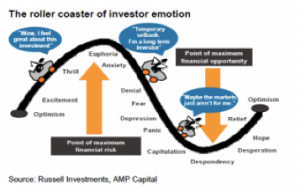

理解信贷领域正在发生的变化是至关重要的。信贷市场是全球最大的金融市场,它推动着整个经济。这是一个高度循环的过程。当利率处于低位、信贷成本低廉时,就会出现"繁荣"。当利率上升和信贷紧缩时,就会出现"萧条"。自2008年金融危机以来,信贷一直很便宜,而且很容易获得。在当前的信贷周期中,企业债务出现了有史以来最大的过剩。当信贷市场开始转向时,随着越来越多的高收益的公司"垃圾"债券(即债务变成坏账),下一场危机将被拉开序幕。

Many experts will tell that gold and silver generate no proper yield or income stream,but that isn't true.First an example scenario to explain how precious metals are rightly employed creating an income stream for the long-term:

许多专家会说,黄金和白银不会产生适当的收益或收入流,但事实并非如此。首先,举一个例子,说明贵金属是如何正确使用的,从而创造长期收入流:

If a house was sold in 1971 for$20,663 and silver purchased for that amount,by January 1980 this investment would have outpaced real estate by a factor of 17,growing to$770,796.If you then sold your silver,you could buy eighteen median-priced single family homes,all in cash at the 1980 price of$42,747 per house and benefit from 100%of cash flows from these properties.

如果一栋房子在1971年以20,663美元的价格出售,并以此价格购买白银,到1980年1月,这项投资将超过房地产17倍,增长到770,796美元。如果你卖掉你的白银,你可以买十八套中等价位的单户住宅,所有的现金都是1980年的价格,每套42,747美元,并且可以从这些房产中获得100%的现金流。

Today the situation is even better for a similar transaction.Real estate has become much more overvalued,and silver has become extremely undervalued.Measured against silver,the median priced single-family home in the US hit its peak in 2002,at a price of 38,123 ounces of silver,some two and a half times higher than at the beginning of the last precious metals bull-market in 1971.

如今,类似交易的情况甚至更好。房地产价值被高估,白银价值被极度低估。以白银衡量,美国单户住宅的价格中值在2002年达到峰值,达到38123盎司白银,比1971年上一次贵金属牛市开始时高出约2.5倍。

When silver hit a peak in 1980 of$52.50,it was not atypical.When the gold and silver market explodes,the financial news will react just as it did in 1980,and the only thing to hear is about gold and silver.The scarcity of silver will go from something that a small fraction of the world population knows about today to something that everyone can become an expert on.It will turn out to be the Dutch tulip mania of 1637 all over again.Expect that less than 500 ounces of silver will buy a median-priced single-family house sometime in the future.

当银价在1980年达到每盎司52.50美元的峰值时,这种情况并不罕见。当黄金和白银市场爆炸时,金融新闻的反应将和1980年一样,唯一能听到的就是黄金和白银。白银的稀缺将从今天世界上一小部分人知道的东西变成每个人都可以成为专家的东西。结果,荷兰1637年的郁金香狂热将再次上演。预计不到500盎司的白银将在未来某个时候购买中等价位的独户住宅。

Riding the opposing cycle of the correct asset class

驾驭正确资产类别的相反周期

因此,现在就买白银,等到白银再次被高估,房地产被低估。

Because both cycles empirically are dissimilar to each other.The best thing to do now is to join the flow of precious metals,by betting that they only go up from here to their true value,which is quite realistic and certainly possible.The winnings will likely be quite large.

因为这两个循环在经验上是不一样的。现在最好的办法是加入贵金属的流动,押注它们只会从这里上升到它们的真实价值,这是相当现实的,当然也是可能的。赢得的奖金可能相当大。

In the above housing sample,even with 50%tax and other expenses included,you could still own twelve homes for rental income,against one home in today's dollars.The biggest mean reversion in history is almost here,and be assured that every asset price over time always returns to the average value in the long run.Whether news is good or bad,once you are riding the cycle of the correct asset class as an investor,it doesn't matter.Investors who are aware of this will experience a huge accumulation of wealth,whereas the ones that are caught unaware may end up with nothing but debt.

在上面的房屋样本中,即使包括50%的税和其他费用,你仍然可以拥有十二套房屋作为租金收入,而不是现在的美元。历史上最大的均值回归几乎就在这里,可以肯定的是,每一个资产价格随着时间的推移总是回归到长期的平均值。无论是好消息还是坏消息,一旦你作为一个投资者正处于正确资产类别的周期中,那就无关紧要了。意识到这一点的投资者将经历巨大的财富积累,而不知情的投资者最终可能只剩下债务。

As encouragement to the Trump Team and the Patriots going ahead by removing the Deep State Globalist mafia,every awake individual can help by flying the American or your own national flag until after the next election on November 3.This is the very best visual demonstration of our solidarity for Q and the Trump Team.

为了鼓励特朗普团队和爱国者通过铲除"深州"全球主义黑手党继续前进,每个清醒的人都可以悬挂美国国旗或自己的国旗来帮忙,直到11月3日下一次大选结束。这是我们对 q 和特朗普团队最好的视觉展示。

Stay tuned–there is important inside information to come…

请继续关注-有重要的内幕消息即将播出..。

Explore the largest community of artists, bands, podcasters and creators of music & audio

来源:http://finalwakeupcall.info/en/2020/08/05/wealth-transfer/